2024 Estate & Gift Tax Update

When making gifts in 2024, taxpayers should consider recent and planned future federal tax changes, including:

In 2024 the gift tax annual per-recipient exclusion increased to $18,000;

In 2024 the gift/estate tax lifetime exemption increased to $13.61 million; but

In 2026 that lifetime exemption is scheduled to plunge to around $5 million.

“The Long Run“ Investment Newsletter - February 2024

We are happy to share the investment insights of our friends at Reynders McVeigh Capital Management, LLC in the February 2024 edition of their “The Long Run“ investment letter. Enjoy!

“The Long Run” Investment Newsletter- July 2023

We are happy to share the July 2023 investment newsletter from our friends at Reynders McVeigh Capital Management, LLC. Enjoy!

“The Long Run” Investment Newsletter- April 2023

We are happy to share the April 2023 investment newsletter from our friends at Reynders McVeigh Capital Management, LLC. Enjoy!

“The Long Run” Investment Newsletter- January 2023

We are happy to share the January 2023 investment newsletter from our friends at Reynders McVeigh Capital Management, LLC. Enjoy!

2022 Year End Considerations

We are happy to share the 2022 year end planning recommendations of our friends at Reynders McVeigh Capital Management, LLC. Enjoy!

"The Long Run" Investment Letter, October 2022

We are happy to share the investment insights of our friends at Reynders McVeigh Capital Management, LLC in the October 2022 edition of their “The Long Run“ investment letter. Enjoy!

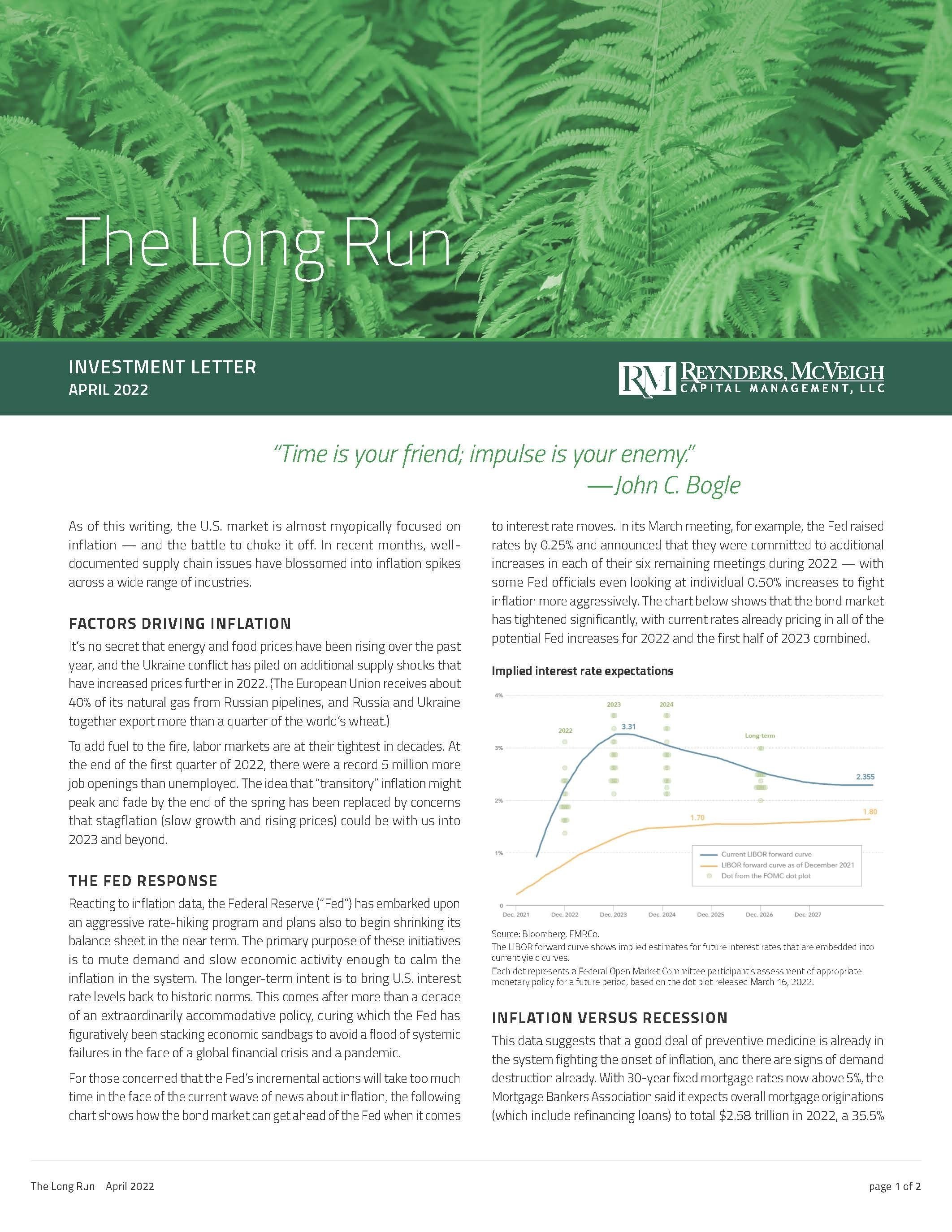

"The Long Run" Investment Letter, April 2022

We are happy to share the investment insights of our friends at Reynders McVeigh Capital Management, LLC in the April 2022 edition of their “The Long Run“ investment letter. Enjoy!

2022 Gift/Estate Tax Update

When making gifts in 2022, taxpayers should consider recent and planned future federal tax changes, including:

In 2022 the gift tax annual per-recipient exclusion increased from $15,000 to $16,000;

In 2022 the gift/estate tax lifetime exemption increased from $11.7 million to $12.06 million; but

In 2026 that lifetime exemption is scheduled to plunge to around $5 million